Worried about tax mistakes?

Optimize your crypto taxes before year-end

Turn actionable insights into smarter decisions

Withdraw crypto stress-free

What Are Crypto Losses?

Crypto losses occur when you sell a cryptocurrency for less than its purchase price. This is calculated as:

Capital Loss = Selling Price - Cost Basis

A negative result indicates a loss. Due to the volatile nature of cryptocurrencies, prices can fluctuate rapidly, leading to potential losses in short periods. More details about the UK cost basis methods can be found here: Crypto Cost Basis Methods

Only realised losses, where you've sold the cryptocurrency at a lower price than what you paid, can be claimed for tax purposes. Unrealised losses, where the market value has dropped but you haven't sold, cannot be claimed.

Looking for more information on UK tax topics? Check out Blockpit’s UK Crypto Tax Guide.

How Can Losses Be Claimed?

To claim crypto losses on your UK tax return, follow these steps:

1. Offset Losses Against Gains: Use your capital losses to reduce your gains down to the Capital Gains Tax (CGT) personal allowance level. There is no limit to the amount of losses you can offset.

2. Carry Forward Excess Losses: If your losses exceed your gains, carry them forward to offset future gains.

3. Register Losses with HMRC: Register your losses by completing a Self Assessment tax return or by sending a formal written notification to HMRC within four years of the loss.

4. Adhere to CGT Rules: Be aware of the same-day and 30-day CGT rules to avoid 'bed and breakfasting', where you sell assets at a loss and quickly buy them back for a tax advantage.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">With the Crypto Tax Optimizer included in Blockpit Plus, you keep more of your gains. By the way: Blockpit Plus costs only £3.49 per month!</p></div></div></div>

How Do I Report Crypto Losses in My Tax Return?

Report your crypto losses to HMRC through a Self Assessment tax return:

- Register: Sign up for Self Assessment on the HMRC website if you’re not already registered.

- Complete: Fill in the Capital Gains Summary pages, reporting all losses, including cryptoassets.

- Submit: Submit your tax return online by 31st January after the tax year ends. Paper returns would need to be submitted by 31st of October.

- Pay: Pay any tax due by the same deadline.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Blockpit's Crypto Tax Calculator generates comprehensive crypto tax reports in PDF format. These reports detail all your crypto gains, income, balances, and transactions, making them suitable as proof of origin for banks or tax advisors.</p></div></div></div>

To report your crypto activities to HMRC, complete two forms:

- SA100: HMRC Self-Assessment Tax Return for income from crypto.

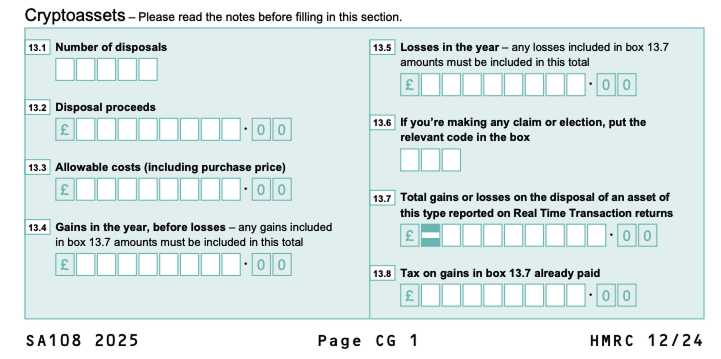

- SA108: Self-Assessment Capital Gains Summary for crypto gains/losses.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Note: The guidelines provided below focus specifically on your crypto activity and investments. If you have other income, capital gains, or losses to report, ensure they are included in the same form.</p></div></div></div>

Form SA100 – Self Assessment Tax Return

The SA100 form, the HMRC Self-Assessment Tax Return, covers income, capital gains, student loans, interest, and pensions. If declaring capital gains or losses, mark box 7 on the SA100 and include the SA108 form, the Capital Gains Summary.

Form SA108 – Capital Gains Tax Summary

A dedicated cryptoassets section has been added to page 1 of form SA108. You need to complete boxes 13.1–13.8.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Tip: The Blockpit tax report clearly shows which figures belong in each box.</p></div></div></div>

After completing the initial section, go to 'Losses and adjustments' on page 3. If you have capital losses from previous years, income losses, or capital losses to carry forward, fill in boxes 45-48.

More Details can be found here: HMRC Crypto Tax Forms

What Types of Losses Can You Incur?

Claiming Realised Losses on Trading Activity

If you've sold cryptocurrency for less than its purchase price, you can claim this as a realised loss on your tax return. This loss can offset other capital gains, reducing your tax liability. Ensure you keep detailed records of all transactions for accurate cost basis calculations.

Claiming Losses on Lost or Stolen Crypto

HMRC does not recognise lost or stolen cryptocurrencies as capital losses since you still own the assets. However, if you can prove permanent loss of access, you may file a negligible value claim to offset future gains.

Claiming Losses on Frozen Funds

If your funds are frozen due to bankruptcy proceedings (e.g., FTX), you cannot claim immediate losses. Wait for the proceedings to conclude. If funds are unrecoverable, a negligible value claim can offset future gains.

Claiming Losses on Rug Pulls

In rug pulls, where developers abandon a project, you often still possess the worthless tokens. To claim a loss, you must dispose of these tokens:

- Selling on Exchanges: Sell tokens if they are still listed.

- Swapping Tokens: Use a wallet to swap delisted tokens for another cryptocurrency.

- Gifting Tokens: Gift tokens to someone other than your spouse.

- Burning Tokens: Send tokens to a burn wallet to destroy them.

- If the blockchain halts, a negligible value claim might be necessary.

Claiming Losses on Worthless NFTs

To claim a capital loss on worthless NFTs, you must dispose of them:

- Selling the NFT: Sell it on a marketplace, even at a minimal price.

- Gifting the NFT: Gift it to someone other than your spouse.

- Burning the NFT: Use platform options to burn or permanently delete the NFT.

FAQ

Can you offset capital losses against income tax?

No, in the UK, capital losses from cryptocurrency cannot be offset against income tax. They can only be offset against capital gains or carried forward to future tax years.

Can crypto losses be carried forward?

Yes, crypto losses can be carried forward to offset future gains. These losses must be registered with HMRC within four years.

Can crypto losses be carried backward?

No, crypto capital losses cannot be carried back to offset gains from previous years. They can only offset gains in the same year or be carried forward.

Do you have to report crypto losses on your tax return?

Yes, you must report all crypto transactions, including losses, if used to offset gains. This can be done via a Self Assessment tax return or by notifying HMRC in writing.

Helpful Links

01/2026: Update for 2026

06/2024: Restructured Tax Guide, Updated Images