Crypto Taxes Stressing You Out?

Get peace of mind with accurate and easy-to-understand crypto tax reports.

Unrivaled Tools for Crypto Tax Calculation

Seamless Sync

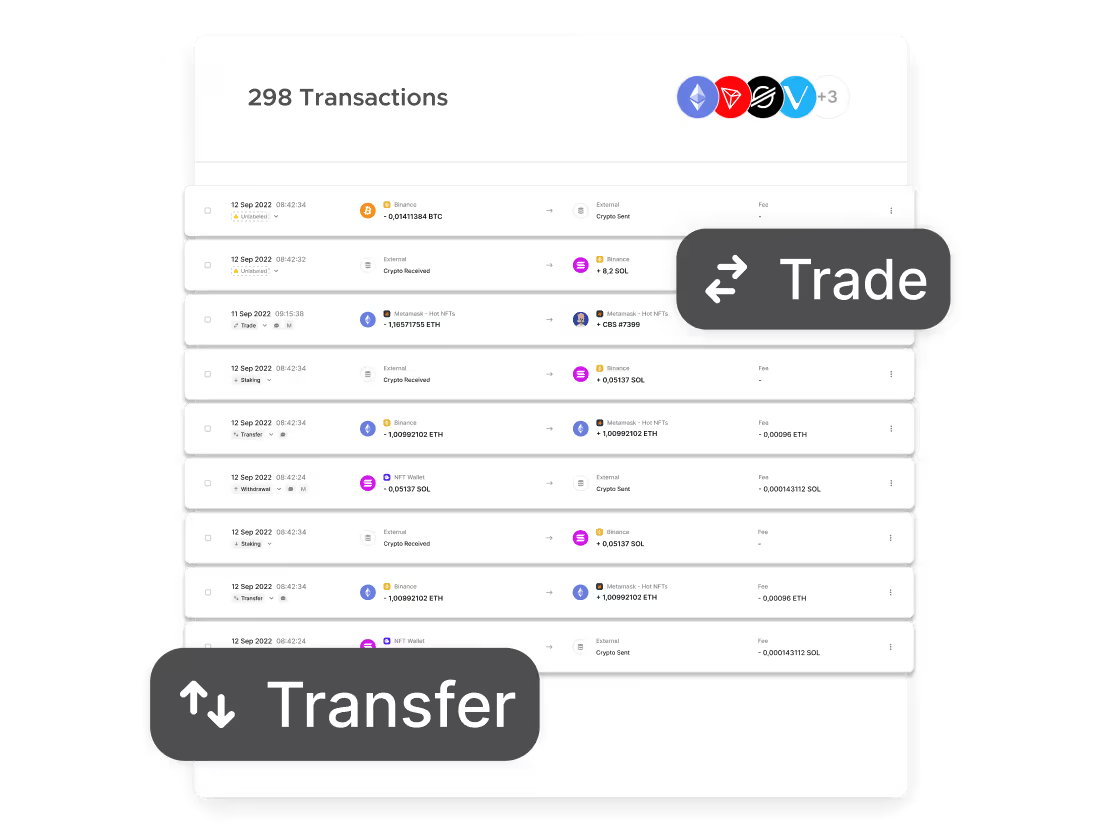

Automatic Classification

Crypto Tax Optimization

Crypto Tax Reporting

Effortless Crypto Tax Calculation

Generate crypto tax reports for your IRS tax return in 3 steps. It's that easy.

1. Import Transactions

Import your transaction history from your wallets and exchanges.

2. Review & Optimize

Gain new insights and discover actionable tax-saving opportunities.

3. Generate Tax Report

Click the button to download your complete crypto tax report.

Designed for Crypto Lovers. Developed by Crypto Experts.

DeFi DemystiFied

Staking, lending, borrowing, liquidity pools, swaps, yield farming – we support it! Import transactions from the DEX of your choice and receive a crypto tax report that any tax agent can understand.

Smart Assistance

Automatic analysis, identification and matching for your transactions and on-chain trades across your entire portfolio.

In-Depth NFT Reports

Let your NFTs shine in your personal NFT Gallery. Receive the most accurate floor prices for your priced collections, as well as additional purchase details and capital gain or loss calculations.

Issue Management

Easily solve issues and fill in the gaps with warnings for missing balances, missing pricing information or unlabeled transactions.

Vast Asset Support

Choose from 500,000+ supported assets, covering everything from the world's largest crypto exchanges to the most obscure blockchains, protocols and dApps. If it has a ticker we probably support it.

Expert Support

We take a lot of pride in our excellent customer service. Our team is standing by to support you on your way to your crypto tax report.

Expert-Backed Tax Reports

We collaborate with KPMG to ensure our tax calculations comply with the specific crypto tax regulations of the IRS in the USA, including long-term and short-term gains, tax-free allowances, and additional tax benefits.

Still have questions?

Blockpit helps you calculate your crypto taxes automatically. Import your transactions and receive a compliant, ready-to-file tax report. Easy to use, accurate, and built for everyone.

The tax report tells you exactly what to declare — including all gains, losses, and taxable transactions. Whether you file on your own or use a tax advisor, it’s your reliable crypto summary for the tax office.

You can easily connect your exchanges using secure API integrations or import transactions via CSV file. Wallets can be linked with your public wallet address. This way, all your transactions are captured automatically — no manual entry needed.

Blockpit supports a wide range of digital and traditional assets, including: Fiat currencies (e.g. EUR, USD, CHF), Cryptocurrencies (coins & tokens), Commodities like gold or silver, Derivatives such as leveraged tokens or tokenized stocks/commodities, and NFTs — both individual items and collections. All transactions are automatically categorized and accurately accounted for in your tax calculations.

No. Blockpit never touches your funds. We use read-only access to import your data using secure API keys or public wallet addresses. Your assets always remain where they are and you stay in full control at all times.