Best Crypto Tax Software: Tool Review [2024]

Discover the best crypto tax solutions in 2024.

Blockpit employs strict editorial principles to provide accurate, clear and actionable information. Learn more about how we create and review content.

tl;dr

- Crypto tax software simplifies the complex process of calculating taxes on crypto transactions

- A good crypto tax calculator understands your local tax regulations

- Not all crypto tax providers support all crypto assets, NFTs or DeFi applications

Crypto investing keeps growing continuously, even during an eventful 2023. NFTs, DeFi and a rollercoaster-like performance for many cryptocurrencies like Bitcoin or Ethereum led to lots of opportunities to buy, trade and sell – and to realize massive gains and losses. And where there are gains and losses, there are taxes.

In this guide, we're taking a close look at some of the best crypto tax software on the market, so you can keep track of your cryptocurrency transactions and optimize your tax obligations with ease.

We’re also sharing some useful tips and information on how to choose the right crypto tax software for your needs, comparing their use cases, features, and pricing.

{{cta-banner-tax-generic="/elements/reusable-components"}}

Best Crypto Tax Tools 2024

<figure class="block-table">

<table>

<thead>

<tr>

<th>Name</th>

<th>NFT Support</th>

<th>DeFI Support</th>

<th>Portfolio Tracking</th>

<th>Pricing</th>

</tr>

</thead>

<tbody>

<tr>

<td>Blockpit</td>

<td>Full Support</td>

<td>Full Support</td>

<td>Yes, Free</td>

<td>from 49€</td>

</tr>

<tr>

<td>CoinTracker</td>

<td>Limited</td>

<td>Limited</td>

<td>Yes, 14€/mo.</td>

<td>from 59€</td>f

</tr>

<tr>

<td>TaxBit</td>

<td>Very Limited</td>

<td>Very Limited</td>

<td> –</td>

<td>free</td>

</tr>

<tr>

<td>Accointing</td>

<td>Limited</td>

<td>Yes</td>

<td>Yes, Free</td>

<td>from 79€</td>

</tr>

<tr>

<td>TokenTax</td>

<td>Yes</td>

<td>Yes</td>

<td>No</td>

<td>from 65$</td>

</tr>

<tr>

<td>Koinly</td>

<td>Yes</td>

<td>Limited</td>

<td>Yes, Free</td>

<td>from 49€</td>

</tr>

<tr>

<td>ZenLedger</td>

<td>Limited</td>

<td>Yes</td>

<td>No</td>

<td>from 49$</td>

</tr>

<tr>

<td>CryptoTaxCalculator</td>

<td>Full Support</td>

<td>Full Support</td>

<td>Yes, Free</td>

<td>from 49$</td>

</tr>

<tr>

<td>Coinpanda</td>

<td>Yes</td>

<td>Yes</td>

<td>Yes, Free</td>

<td>from 49$</td>

</tr>

<tr>

<td>Coinledger</td>

<td>Limited</td>

<td>Yes</td>

<td>No</td>

<td>from 49$</td>

</tr>

</tbody>

</table>

</figure>

What is a crypto tax software?

A crypto tax software is a tool that helps individuals and businesses calculate and file their taxes related to cryptocurrency transactions. These transactions can include buying and selling cryptocurrencies, rewards from staking or mining, receiving or paying for goods and services with cryptocurrencies, and exchanging one cryptocurrency for another.

A crypto tax software typically integrates with popular cryptocurrency exchanges and crypto wallets to automatically import transaction data, track performance, and then use this data to generate tax reports.

In many cases, a good crypto tax software will also show you opportunities for tax optimization, such as tax loss harvesting.

Why do you need crypto tax software?

With the increasing popularity of cryptocurrencies, tax agencies around the world are starting to crack down on individuals and businesses who fail to report their crypto-related income or gains.

Having the right crypto tax software can help ensure compliance with tax laws and avoid costly mistakes or audits. Whether you're a crypto trader, miner, or simply an enthusiast, it's essential to keep accurate records of your transactions and stay informed about the latest tax laws.

Additionally, new blockchain applications and cryptocurrency use cases may be treated in many different ways when it comes to taxation.

Similarly, crypto tax regulations may differ vastly from country to country, with some applying very detailed frameworks for individual asset classes and others utilizing more of a blanket approach.

Crypto tax software will help you stay on top of an always changing regulatory environment and ensure that your transactions are categorized and reported correctly.

Do I need to pay taxes for my crypto transactions?

This is a tough question to answer, specifically because tax laws can be complex and differ from country to country. Click on the links to receive in-depth information from our advanced crypto tax guides.

Crypto taxation in Germany levies the personal income tax rate on crypto gains. However, If the holding period exceeds one year, the asset can be sold tax-free.

Crypto taxation in Austria levies a flat tax rate of 27,5% for most crypto gains. It is also worth mentioning that swapping crypto for crypto is tax-free since the implementation of the new crypto tax regulation (March 1st, 2022).

Crypto taxation in France levies a flat tax rate of 30% on capital gains from crypto assets for occasional investors. However, capital gains below 305€ per year are tax-free. Additionally, french taxpayers are required to report all crypto holdings with foreign institutions using Cerfa 3916.

Crypto taxes in the Netherlands are handled a little differently, by declaring the total value of your assets (not just crypto) on January 1st of the tax year.

Crypto taxation in Belgium is still showing a lot of uncertainty regarding crypto taxes. A flat tax of 33% is applied on capital gains from most crypto transactions, but also income tax may incur in some cases.

Crypto taxation in the United States treats cryptocurrency as property, subject to capital gains and income tax.

Crypto taxation in the UK looks at cryptocurrency and other cryptoassets as digital assets, subject to capital gains and income tax.

Who benefits from crypto tax software?

Many different types of individuals can benefit from crypto tax software including:

- Traders: If you are regularly buying, selling or trading cryptocurrencies you will need to find a way to keep track of your transactions, gains and losses to successfully calculate your tax liability.

- Investors: Long-term investors and HODLers benefit from portfolio tracking features to keep an eye on their portfolio performance across wallets and exchanges.

- Tax professionals: Use crypto tax software to make sure your clients are in compliance with tax laws.

Essential features for a crypto tax tool

A good crypto tax solution needs to offer various different functionalities to generate accurate tax reports. These include:

- Automatic import of transaction data from exchanges and wallets via API connection or public key import

- Manual import of transaction data via CSV upload

- Identification and tracking of cost basis and capital gains/losses

- Support for all major cryptocurrencies and blockchains

- Ability to handle forks, airdrops, and other complex transactions

- Ability to handle margin trading, futures, and derivatives trading

- Ability to handle tax loss harvesting

- Support for inventory methods like FiFo

- Accurate calculation of taxes owed based on country and jurisdiction-specific tax laws

- Individual tax form generation

- Secure storage of user data and encryption of sensitive information

- Data visualization and reporting tools

{{cta-banner-generic-en="/elements/reusable-components"}}

What should you look for when choosing crypto tax software?

Make sure that your chosen crypto tax software offers country specific tax reports for the tax country you are a tax resident in. While some crypto tax solutions only generate generic tax reports, others can provide specific reports and analysis for your country’s tax framework.

Similarly, automatic imports of the transaction data from crypto exchanges, wallets and blockchains are a crucial necessity, keeping the effort of manually importing transactions to a minimum.

Dedicated customer support is also something to look out for.

Most crypto tax tools offer the option to try most features for free before purchasing a license. It is recommended to test the software intensively before making any decisions.

How does crypto tax software work?

Broadly speaking, crypto tax software calculates your tax liability by analyzing all your cryptocurrency transactions. Thankfully, crypto transactions are stored publicly on the blockchain.

First, the software needs to import the transaction data from exchanges, wallets or directly from a blockchain.

If an automatic import is not possible, you can manually add missing transactions or upload a spreadsheet.

Next, the software takes the transactions and categorizes them based on various factors like date, time, transaction type, cost basis and fair market value.

With this foundation the software can calculate the gains and losses and in a further step calculate a tax report.

If your crypto tax solution supports country-specific tax frameworks it can also show you how to fill out the tax declaration forms.

Crypto Tax Software Comparison 2024: The best Tax Solutions for your Crypto Trades

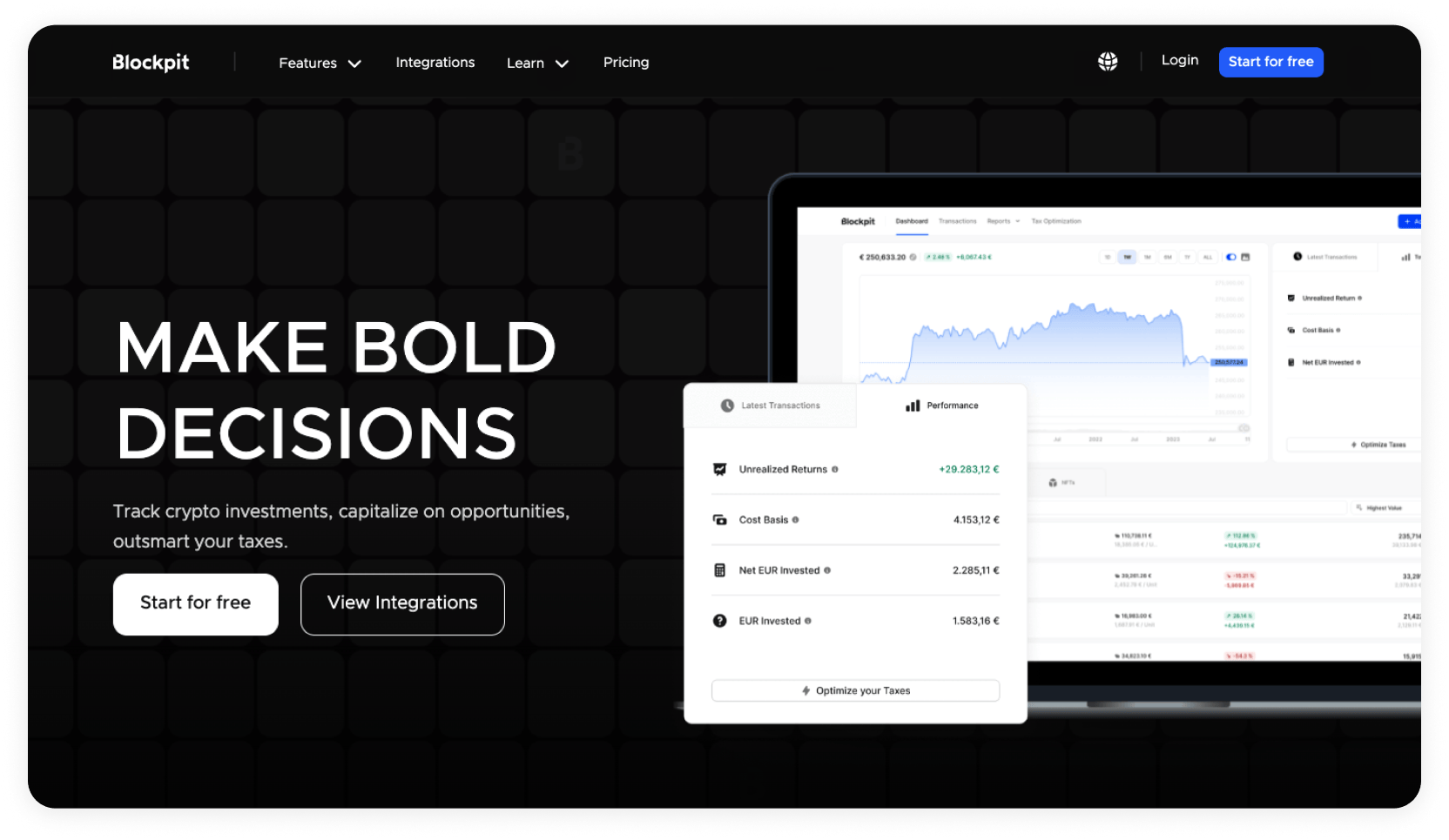

Blockpit

Founded in 2017, Blockpit was one of the first companies in Europe to take on the taxation of crypto assets and provide a leading crypto tax solution for individual investors.

The company is also actively involved in shaping and enforcing crypto regulation within European policies.

Blockpit offers country specific tax reports, pre-filled tax forms and explanations for tax authorities. Blockpit’s tax reports have created in cooperation KPMG.

Blockpit supports a vast number of crypto exchanges, wallets, and blockchains. The crypto tax solution is one of few that take a sophisticated approach to the taxation of NFTs, DeFi protocols, staking and mining.

A tax optimization feature highlights opportunities to lower your tax obligations within a tax year, such as tax loss harvesting.

In addition, Blockpit provides a highly dedicated customer support.

Blockpit’s crypto portfolio tracker can be used for free, while the tax calculator requires a license to generate your crypto tax report.

Features

- Country-specific tax reports

- Pre-filled tax forms

- Explanations for tax authorities

- Individual tax treatment for various asset types (crypto, NFTs, derivatives, commodities, fiat

- View NFT images directly in the transaction overview

- DeFi support

- Tax optimization and portfolio tracking included

- Country-specific tax frameworks can't be changed after setup

- No advanced portfolio tracking features

Pricing

Per Tax year:

- Free – Portfolio tracking without tax reports

- Lite – 49€ – Portfolio tracking, tax reports for up to 50 transactions

- Basic – 79€ – Portfolio tracking, tax reports for up to 1k transactions, tax optimization feature

- Pro – 199€ – Portfolio tracking, tax reports for up to 25k transactions, tax optimization feature

- Unlimited – 599€ – Portfolio tracking, tax reports for unlimited transactions, tax optimization feature

Trial

Free trial with unlimited import of transactions and portfolio tracking. No tax report.

NFT & DeFi

NFT support on Ethereum, Polygon, Solana, Terra, Crypto.org, Avalanche, Klaytn, Fantom, Tron, BNB Smart Chain, Harmony, Velas, XRP / (including images)-

Support of major DeFi protocols on Ethereum, Polygon, Solana, Terra, Crypto.org, Avalanche, Klaytn, Fantom, Tron, BNB Smart Chain, Harmony, Velas, XRP, Osmosis, Moonbeam, Kujira-

Country Support

Germany, USA, Austria, France, Spain, Netherlands, Switzerland, Belgium

{{cta-banner-tax-generic="/elements/reusable-components"}}

CoinTracker

CoinTracker stands out by offering a free tier including tax report, auto sync with unlimited exchanges and wallets and basic portfolio tracking for users with up to 25 transactions.

CoinTracker’s crypto tax software supports more than 300 exchanges and 8000 cryptocurrencies and is able to connect to platforms like TurboTax or TaxAct for e-filing of your tax report in the US.

Country-specific tax support is available for USA, India, UK, Canada, and Australia and partial support for several other countries.

You have the option to share your tax report with tax professionals for further guidance.

CoinTracker’s pricing is based on your number of transactions.

Features

- NFT Gallery for Ethereum addresses

- automatically connect to TurboTax, H&R Block Online, TaxAct, or Wolters Kluwer CCH for e-filing of tax report

- Limited options for manual editing of transactions

- Only shows NFT images on Ethereum

- Lack of DeFi support on other chains

- Tax loss harvesting feature only integrated in portfolio management plan (Pro)

Pricing

Portfolio management:

- Enthusiast - $14 per month

- Pro - $99 per month (includes tax loss harvesting feature)

Per tax year:

- Hobbyist – 59€ – up to 100 transactions

- Premium – 179€ – up to 1k transactions

- Unlimited priced individually

Trial

Free tier with 25 transactions including tax report, unlimited import of transactions, basic portfolio tracking

NFT & DeFi Support

Support for NFTs on Ethereum and Solana

Support for DeFi on Ethereum

Country Support

Full support for US, India, UK, Canada, and Australia and partial support for several other countries.

TaxBit

TaxBit was founded in 2018 and has a strong focus on the United States, but can be used by anyone being subject to a similar tax regime.

TaxBit recently changed their business model to offering fewer features but being 100% free, while supporting an unlimited number of transactions.

TaxBit crypto tax software offers fully supported integrations of certain crypto exchanges, as well as self-service integrations for various blockchains and wallets.

Be aware that TaxBit does not provide customer support.

Features

- 100% Free

- Poor UX

- Hard to manually edit transactions

- Basically no support

- No tax loss harvesting feature

Pricing

Free – Unlimited transactions

NFT & DeFi Support

Very basic NFT and DeFi support

NFTs are shown without images

Country Support

USA focus, available worldwide

Accointing

Accointing, similar to CoinTracker, is offering a free version for users with up to 25 transactions including tax report calculation and all other features like tax-loss harvesting and quick issue fixing.

Country-specific tax reports are available for the USA, UK, Germany, Switzerland and Austria and generic reports can be used wherever FiFO, LiFO or HiFo is supported.

Crypto transactions can be imported by connecting various exchanges and wallets via API keys, uploading a CSV-file or manually.

In addition, the Accointing Crypto Tracker offers crypto portfolio tracking.

Features

- Distinction between Crypto, Fiat, Metal, NFT

- Tax loss harvesting feature

- Quick issue fixing

- UI looks outdated, handling is not intuitive

- No country specific, pre-filled tax forms

Pricing

Per tax year

- Hobbyist – 79€ – up to 500 transactions

- Trader – 199€ – up to 5.000 transactions

- Pro – 299€ – up to 50.000 transactions

Trial

25 transactions free + full feature set

NFT & DeFi Support

Yes, but NFTs are shown in the transaction overview without picture.

Country Support

USA, UK, Germany, Switzerland, Austria

Generic reports wherever FiFO, LiFO or HiFo is supported

TokenTax

TokenTax started back in 2017 and aims to make DeFi more accessible by providing a simple and straightforward solution for crypto taxes in the US, UK and Canada.

The initial version from 2017 imported data directly from Coinbase, and the basic plan today still only supports Coinbase and Coinbase Pro accounts.

TokenTax’ crypto tax solution provides a very intuitive interface and comes with a tax-loss harvesting feature (requires premium plan or better.)

Their tax reports support FiFO, HiFO and LiFO reporting methods, thereby providing partial support for tax frameworks outside the US, UK or Canada.

Transaction data can be imported automatically from numerous exchanges via API key, inserted manually or uploaded via CSV file.

Features

- Intuitive interface

- Tax-loss harvesting feature

- No free trial

- Base plan supports only Coinbase and Coinbase Pro

Pricing

Per tax year

- Basic – $65 – up to 500 transactions

- Premium – $199 – up to 5.000 transactions, tax loss harvesting feature

- VIP – $3.499 – up to 30.000 CEX transactions, tax loss harvesting feature

Trial

No free trial

NFT & DeFi Support

Yes

Country Support

US, UK, Canada + Generic reports

Koinly

Koinly belongs to the most popular crypto tax tools out there. The tax calculator shines with a very beginner-friendly and intuitive interface.

The extensive free version offers, apart from the tax reports, almost all features for up to 10.000 transactions.

Generic tax reports for 34 countries are available, supporting multiple cost-basis methods.

US customers can export a file that can be uploaded directly into a tax filing software like TurboTax or TaxACT.

Koinly supports more than 20.000 cryptocurrencies, numerous exchanges, wallets and blockchains and is compatible with DeFi, Margin and Futures trading.

Noteworthy are also the error reconciliation features, helping users to improve the quality of their transactions.

Features

- TurboTax Online (and CD/DVD), TaxACT

- Multiple cost-basis methods

- Smart transfer matching between your own wallets

- Good user experience, easy to reconcile transactions manually

- Basic NFT support (not showing the pictures in the transaction overview) for most EVM-based blockchains such as Ethereum, BNB Smart Chain, Fantom, Avalanche, Polygon, Cronos as well as Solana.

- No tax-loss harvesting feature

- No prefilled country specific tax reports outside the USA

Pricing

- Newbie – 39€ – up to 100 transactions

- Hodler – 89€ – up to 1.000 transactions

- Trader – 169€ – up to 3.000 transactions

Trial

Free trial with up to 10.000 import transactions. No tax report.

NFT & DeFi Support

NFT support for EVM-chains and Solana

DeFi support for basic 1:1 transactions

Country Support

Generic tax reports for 34 countries (support of multiple cost-basis methods depending on country: FIFO, LIFO, HIFO, Average Cost, Share Pooling & Spec ID)

Pre-filled tax form for USA

ZenLedger

ZenLedger was founded in 2017 and comes with a free trial version for up to 25 transactions including most features except DeFi, Staking and NFT support.

The subscription plans differ between the Crypto Tax DIY Plans and Tax Professional Prepared Plans. Whereas the former are plans similar to those offered by the previous platforms, the latter are more costly alternatives that fully take the hassle of crypto taxes out of your hand.

ZenLedger’ crypto tax software has a strong focus on the US, which is why country specific pre-filled tax forms are only available for the US, including an integration for TurboTax.

Generic reports are available for every country where either FiFO, LiFO or HiFO is used. A tax-loss harvesting tool is also included in every plan.

Features

- TurboTax Integration

- Tax-Loss Harvesting Tool

- Hard to edit transactions manually

- Strong US focus

Pricing

Per Tax year

- Starter – $49 – up to 100 transactions

- Premium – $149 – 5.000 transactions

- Executive – $399 – up to 15.000 transactions

- Platinum – $999 – unlimited transactions

Trial

Free trial with up to 25 transactions and full report functionality.

NFT & DeFi Support

Yes, but NFTs without picture

Country Support

Country specific pre-filled tax form only for the US.

Support for every country where either FiFo, LiFo, or HiFo is used.

CryptoTaxCalculator

CryptoTaxCalculator is an Australian company founded in 2018.

Its crypto tax tool comes with a generous free version including three crypto exchange or wallet integrations and a basic tax report for up to 100 transactions.

Access to the various features, like advanced reports, tax loss harvesting or priority support, depend on the subscription model. Multiple exchanges can be integrated via API keys, CSV uploads are supported as well.

CryptoTaxCalculator provides generic reports with predefined country-specific tax settings for 22 countries – but no pre-filled tax forms.

Features

- Generous free version

- Hard to manually edit transactions (especially converting deposits/withdrawals to trades or transfers)

- Weak token database, i.e. tokens listed under the top 200 on Coinmarketcap are not recognized by the software

- Overwhelming UI with a lot of information

Pricing

Subscription, billed yearly

- Hobbyist – 99€ – up to 1.000 transactions

- Investor – 249€ – up to 10.000 transactions, tax loss harvesting

- Trader – 499€ – up to 100.000 transactions, tax loss harvesting

Trial

Free trial with up to 100 transactions, 3 integrations, and basic tax report.

NFT & DeFi Support

Yes

Country Support

Generic reports with predefined country-specific tax settings for each of the supported countries: Canada, US, Australia, Japan, New Zealand, Singapore, Austria, Belgium, Germany, Finland, France, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom, South Africa.

Coinpanda

Coinpanda’s crypto tax calculator is the way to go if you don’t exceed 25 transactions.

The free license includes unlimited imports, DeFi, NFTs, Margin trading and of course, tax reports.

Country specific reports are available for countries like the US, Canada, Germany and Norway.

Capital gains can be calculated for all countries that use FiFO or LiFO as cost basis methods.

Reports are available for TurboTax, TaxAct and Wolters Kluwer.

Coinpanda supports more than 7.000 cryptocurrencies and a vast number of exchanges via API import.

Features

- TurboTax, TaxAct, Wolters Kluwer

- shows NFT pictures directly in the transaction overview

- very hard to reconcile transactions manually

- very basic tax loss harvesting feature

Pricing

Per tax year

- Free – 25 transactions

- Hodler – $49 – up to 100 transactions

- Trader – $99 – up to 1.000 transactions

- Pro – $189 – up to 3.000 transactions

Trial

Free plan with up to 25 transactions and tax report.

NFT & DeFi Support

Yes

Country Support

Coinpanda supports all countries that use FIFO or LIFO cost basis methods for calculating capital gains. Custom tax reports & forms for certain countries like the US, Canada, Germany & Norway.

Coinledger

Coinledger, founded in 2018, started with an exclusive focus on the US, expanded to Australia and is now available for every country that is using FiFO, HiFO, LiFO or ACB calculation methods.

Coinledger’s crypto tax software comes with support for TurboTax, TaxAct, H&R Block Desktop and TaxSlayer integration.

The free license supports an unlimited number of transactions but no tax reports.

The interface is user-friendly and a lot of guides help you to import all of your transactions from different exchanges, wallets and blockchains.

Features

- TurboTax integration, TaxACT, H&R Block Desktop, TaxSlayer

- Country specific tax report only for US

Pricing

- Hobbyist – $49 – up to 100 transactions

- Investor – $99 – up to 1.000 transactions

- Unlimited – $199 – up to 3.000 transactions

Trial

Free plan with unlimited import of transactions. No tax report.

NFT & DeFi Support

Yes, NFTs without pictures.

Country Support

Prefilled country specific tax report only for US.

Generic reports with either FiFo, LiFo, HiFo or ACB (Adjusted Cost Base) calculation method

Crypto tax software alternatives

There are scenarios where a specialized crypto tax software might not be the best solution. If you think this applies to you, you can use these alternatives:

Do it all yourself

If you know what you are doing, understand your country’s specific tax regulations and have enough time on your hands, you are free to file your crypto gains and losses yourself. This might be a viable option when you have only made a few basic trades and are familiar with the tax forms.

Be aware that you might face harsh penalties or at least an additional workload when you fail to report your gains accurately.

Be sure to check out our advanced crypto tax guides to learn how to dow crypto tax reporting on your own.

Talk to a professional

Certified public accountants, tax advisors, consultants and lawyers are able to file your taxes for you. Make sure to look for individuals or firms with experience in handling crypto investments.

Head over to HalloSophia to find a crypto tax expert in your area.

Be aware that tax professionals still require a complete history of your transactions and that you will be charged a fee.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">If you are already using an accountant or tax advisor for other reasons, you can save time and money (and make their life a lot easier) by using a crypto tax software to easily record and export all relevant information in a way that will guarantee to turn you into their favorite client.</p></div></div></div>

{{cta-banner-tax-generic="/elements/reusable-components"}}

Conclusion

Between trading, NFTs, mining, staking, lending and all the other exciting use cases, there is a good chance that your crypto activities have resulted in a tax obligation, whether you are aware of it or not.

A good crypto tax software will save you time, money and peace of mind when filing a tax report for your cryptocurrency gains and losses.

Be sure to choose a solution that fully understands your local tax regulations and stays up to date with recent developments and changes – like Blockpit!

Crypto Tax Software – FAQ

How are cryptocurrencies taxed?

Cryptocurrencies are typically taxed as property, with capital gains or losses realized upon the sale, trade, or use of the digital asset. Tax liabilities depend on the holding period, jurisdiction, and individual circumstances. To sum it up: it depends.

Check out or crypto tax guides to learn more about crypto taxation in your jurisdiction.

Do crypto exchanges like Binance or Coinbase report directly to the tax authorities?

Yes, many crypto exchanges, including Binance and Coinbase, are required to report certain transactions to tax authorities in compliance with jurisdiction-specific regulations. While this seems to be specific to the US, we’re also seeing similar efforts and developments in Europe – most recently with the new DAC8 directive.

Can tax authorities track crypto transactions?

Tax authorities are increasingly developing methods and collaborating with other agencies to track cryptocurrency transactions. While some cryptocurrencies offer a degree of anonymity, most transactions on public blockchains can be traced through their unique identifiers. Additionally, tax authorities may collaborate with crypto exchanges or other financial institutions to gather information on users' crypto transactions.

How do I import crypto transactions into the crypto tax software?

Most of your transactions can usually be imported automatically by connecting your exchange or wallet with the crypto tax tool. This can happen with API keys or through public keys. Everything else can be imported manually or by uploading a CSV file.

Can I file the crypto tax return myself?

Yes, of course. Blockpit offers a software solution for creating your crypto tax return to support your efforts.