Keep more of your crypto profits.

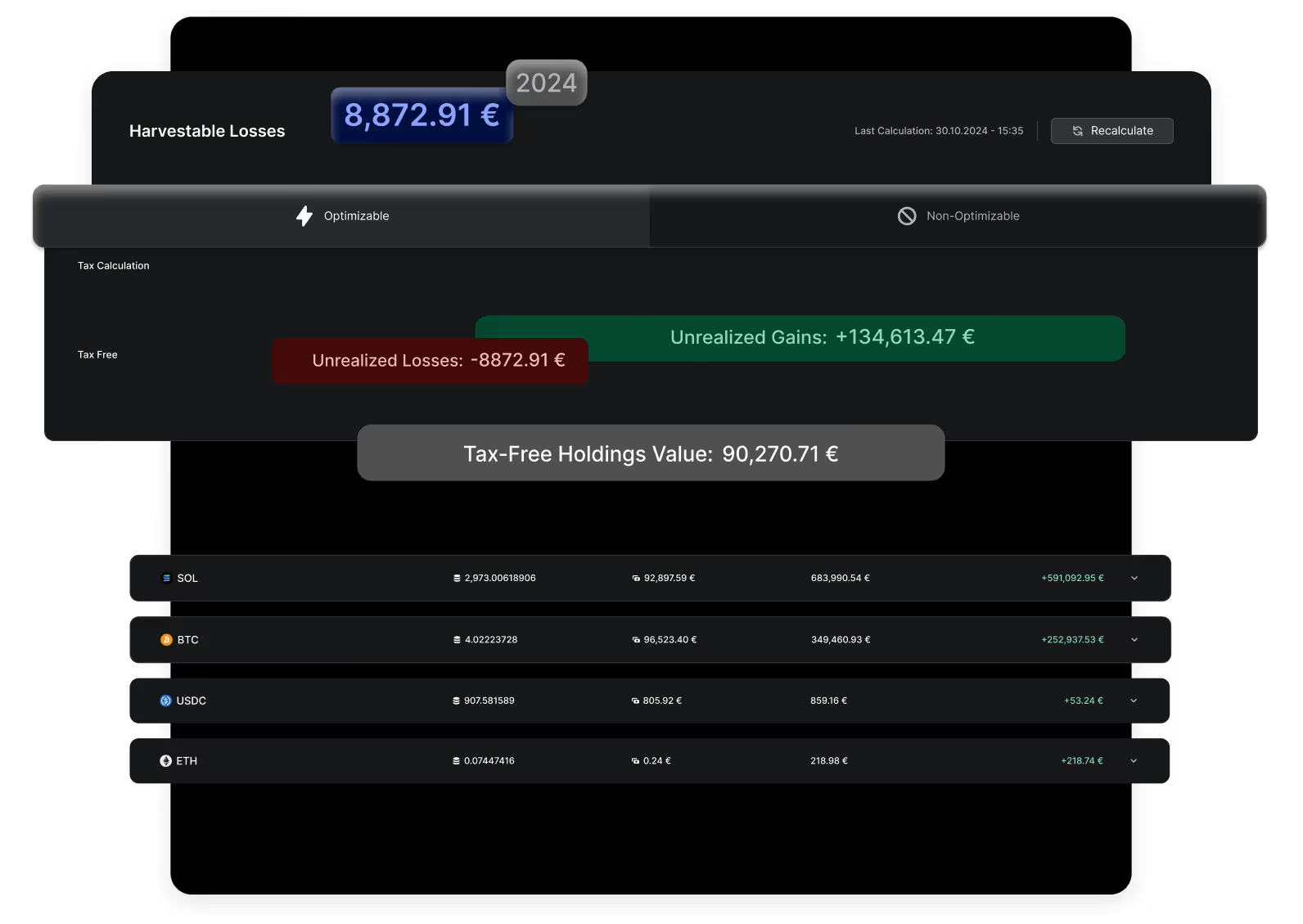

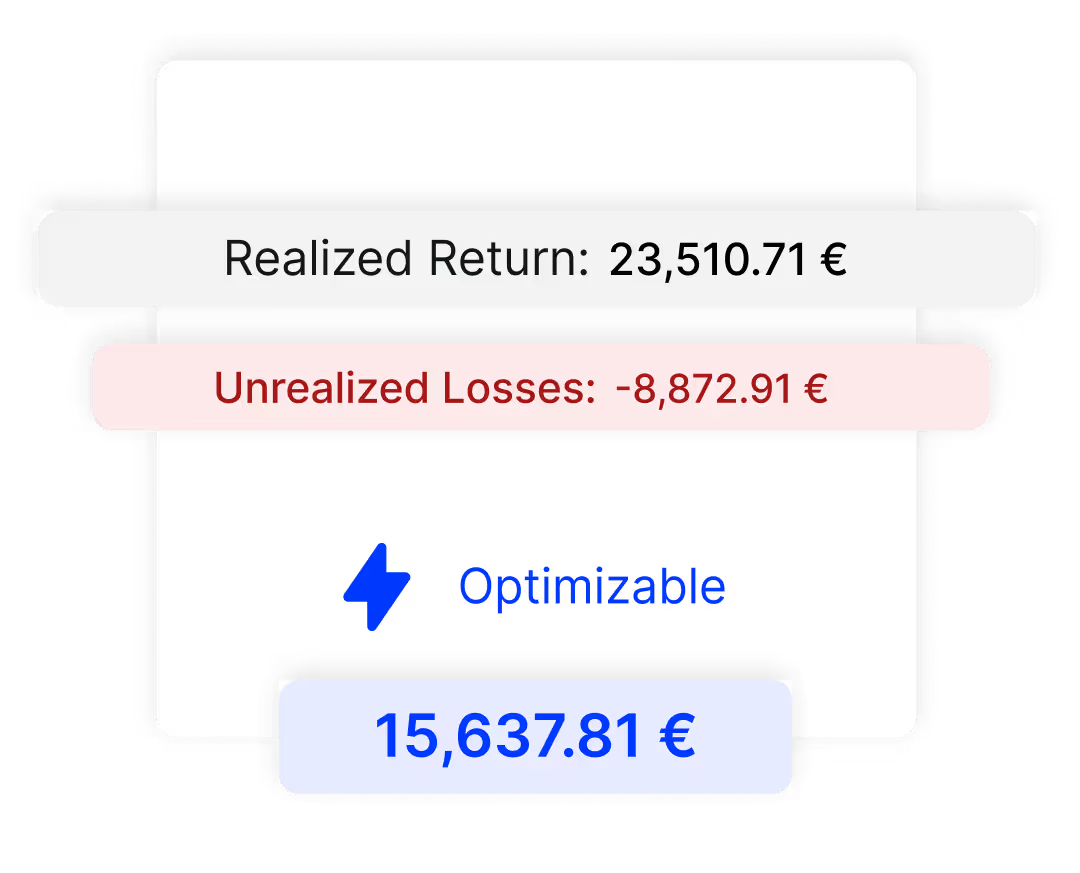

Analyze your crypto portfolio to discover tax-saving opportunities, identify tax-free sales and use losses to your advantage.

Turn Bad Bets into Tax Wins

Uncover Opportunities

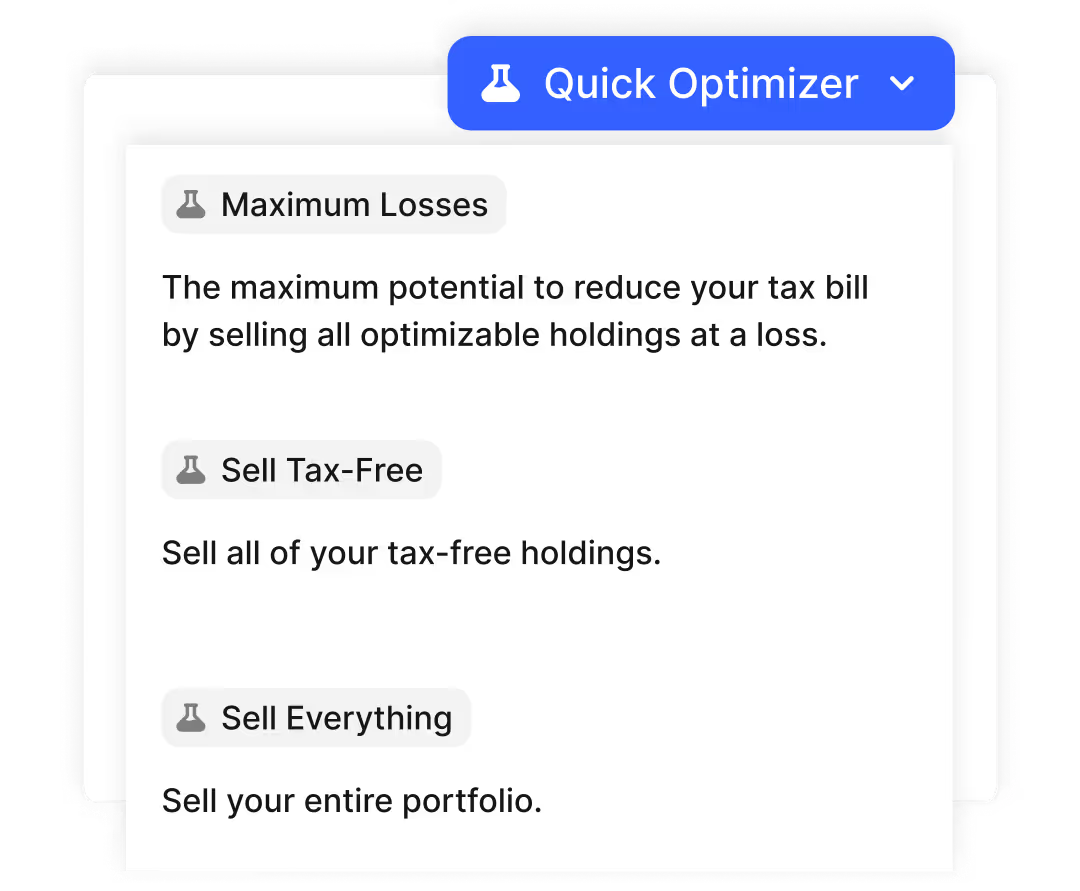

Simulate Strategies

Actionable Insights to Save Actual Money

Tax Optimization requires an active Blockpit Plus subscription.

1. Sign Up for Free

Create a free Blockpit Account and join more than 300,000 crypto investors.

2. Import Your Portfolio

Add integrations and import your entire transaction history.

3. Analyse & Optimise

Find hidden opportunities, simulate transactions and save taxes.

Your guide to smarter crypto taxes

Blockpit helps you spot where timing and loss offsets might reduce your tax burden — no tax knowledge required, and fully compliant.

No. Blockpit can find tax opportunities in your portfolio even if you're not an active trader.

Tax-loss harvesting means selling underperforming assets to offset taxable gains. Blockpit automatically detects these opportunities and makes them easy to use — no manual tracking needed.

Yes, it’s completely legal. Losses can be used to reduce your overall tax burden. Blockpit helps you identify and document these opportunities correctly and automatically.