Crypto Taxes Austria: Complete Instructions [2024]

The complete guide to Austria's crypto taxes incl. the Eco-Social Tax Reform of March 1st, 2022.

Blockpit employs strict editorial principles to provide accurate, clear and actionable information. Learn more about our Editorial Policy.

Key Takeaways

- Since the new tax reform (March 1st, 2022), Austria distinguishes between old and new assets.

- The exchange from crypto to crypto (e.g. Bitcoin → Ethereum) is now tax-free!

- There is now only a fixed tax rate of 27,5% for (almost) everything.

- NFTs are still treated under the old regime (holding period, exemption limits and taxation at the progressive income tax rate).

Crypto Tax Basics

In 2023, the crypto market saw notable gains, especially in Bitcoin and Ethereum, buoyed by better macroeconomic conditions, potential approval of Bitcoin and Ether ETFs in the USA, and significant updates like the Bitcoin Halving and Ethereum's Dencun. Despite regulatory risks, the sector's future looks promising, with continued growth expected into 2024.

A law came into effect in Austria on March 1st 2022, which regulates crypto taxes to the greatest extent possible.

Whether you are directly or indirectly affected by these events, or have realized gains or losses trading cryptocurrencies in other ways, it all needs to end up correctly in your tax return. In our crypto tax guide 2024 for Austria, we show you exactly how to collect all relevant information for the tax office and get the most out of your crypto tax return.

{{cta-banner-tax-generic="/elements/reusable-components"}}

Are cryptocurrencies taxed in Austria?

Short answer: yes.

Long answer: whether cryptocurrencies need to be taxed in Austria depends on several factors.

Since the new tax reform came into effect on March 1st 2022, a distinction is made between old and new holdings. The classification has an impact on the amount at which tax is paid. After one year of holding, holdings from old stock no longer have to be taxed. In addition, the old regulation had certain exemption limits under which gains remained tax-free. Both of these are no longer possible under the new rules.

On the other hand, crypto-to-crypto exchanges are now no longer taxable.

As you can see, this issue is complex. Please refer to the relevant chapters for even more detailed explanations.

What does the new tax reform mean for my crypto tax return?

In Austria, a new law that regulates crypto taxes to the greatest extent possible came into effect on March 1, 2022. It was first published in full as part of the Ecosocial Tax Reform on February 14, 2022 in the Federal Law Gazette for the Republic of Austria.

For users, the tax reform impacts how cryptocurrencies must be taxed. First and foremost, the date on which you purchased your assets is important for your tax settlement.

The specific purchase date determines whether your crypto assets belong to the old stock or already to the new stock. This classification determines whether you have to pay tax on your crypto gains at the progressive income tax rate (old stock) or at the fixed tax rate of 27,5% (new stock).

Cryptocurrencies purchased on or before February 28, 2021 are part of the old stock. Price gains and crypto income may be tax-free in this case.

The requirement is that you have held your assets for at least 1 year (365 days). Transactions involving non-interest-bearing crypto assets held for a long period (e.g., sale and exchange of cryptocurrencies or mining) are taxed at the progressive income tax rate if you dispose of them within a year. Interest-bearing crypto assets held for a long period are also taxed at the special tax rate of 27.5%.

Cryptocurrencies purchased on or after March 1, 2021 will be part of the new stock.

As of this date, cryptocurrencies and assets can no longer be sold tax-free.

The special tax rate of 27,5% will apply if cryptocurrencies are sold after March 1, 2022. New stock cryptocurrencies (purchase date March 1, 2021 or later) sold before March 1, 2022 will be taxed at the progressive income tax rate (up to 55%). The purchase of cryptocurrencies, on the other hand, is and will remain tax-free.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Because there are both users who have been in crypto for years and at the same time many for whom crypto is still new territory, we will go into detail about both the old and the new legal situation (valid from March 1, 2022) in our crypto tax guide.</p></div></div></div>

How are crypto taxes calculated in Austria?

Here’s how cryptos are taxed from March 1st, 2022 (new rules)

The new crypto tax reform is effective from March 1, 2022 and brings a number of changes, which we take a detailed look at here.

Benefits of the new crypto tax reform.

- Crypto-to-crypto exchanges (e.g. Bitcoin → Ethereum) are tax-free.

- There is now only a fixed tax rate of 27,5%, which you need to remember.

- You can do a joint loss offset with other capital market transactions like bonds, derivatives, etc.

Where there is light, there is usually also shadow. This is probably what HODLers are thinking right now, as they hold crypto investments primarily for the long term.

Disadvantages of the new crypto tax reform

- There’s no tax exemption anymore if you hold cryptocurrencies for more than a year.

- Cryptocurrencies purchased after February 28, 2021, will also fall out of the tax-free one-year holding period. (So only those who bought cryptocurrencies before February 28, 2021 and held them for at least 365 days can sit back and relax).

- The annual exemption limit of €440 is history.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">With the eco-social tax reform, cryptocurrencies are equated to capital assets under income tax law. This means that cryptocurrencies are equal to stocks, bonds, dividends, etc. in terms of taxation. With this, Austria creates a clear legal basis that makes life a bit more difficult for HODLers*, but at the same time offers traders options to invest their crypto assets in a tax-friendly way.</p></div></div></div>

Here’s how cryptos were taxed before March 1st, 2022 (old rules).

As long as your gains stay below the 440€ exemption limit, you don’t have to pay taxes on them. Moreover, all your crypto profits on assets and the gains from the sale or exchange of rewards from staking, lending, and bounties, that you bought or received before February 28, 2021, and didn’t sell for at least one year are tax-free.

However, if you bought and resold crypto within one year (365 days), the disposal will count as private speculative transactions. They must then be taxed at the progressive income tax rate. Specifically, this applies to crypto-to-crypto exchanges and crypto-to-fiat currency exchanges.

Progressive means that the amount of taxation on cryptocurrencies depends on your personal income.

To give you a better overview, we have mapped the income tax rates for 2023 in a table.

<figure class="block-table">

<table>

<thead>

<tr>

<th>

<strong>Income from €</strong>

</th>

<th>

<strong>Income to €</strong>

</th>

<th>

<strong>Tax rate</strong>

</th>

</tr>

</thead>

<tbody>

<tr>

<td >0</td>

<td >11,693</td>

<td >0 %</td>

</tr>

<tr>

<td >11,693</td>

<td >19,134</td>

<td >20 %</td>

</tr>

<tr>

<td >19,134</td>

<td >32,075</td>

<td >30 %</td>

</tr>

<tr>

<td >32,075</td>

<td >62,080</td>

<td >41 %</td>

</tr>

<tr>

<td >62,080</td>

<td >93,120</td>

<td >48 %</td>

</tr>

<tr>

<td >93,120</td>

<td >1,000,000</td>

<td >50 %</td>

</tr>

<tr>

<td >1,000,000</td>

<td ></td>

<td >55 %</td>

</tr>

</tbody>

</table>

<figcaption>Income tax rates 2023 Austria</figcaption>

</figure>

Calculate cryptocurrency tax (with example)

At first glance, the uniform tax rate of 27,5% is a welcome simplification for crypto users in Austria. In everyday life, however, the situation often turns out to be much more complex:

If you exchange crypto to crypto, this does not trigger a tax liability, but the acquisition costs have to be passed on. In a way, you can put off taxation.

However, should you decide at some point to exchange your cryptocurrencies for euros (or even an NFT), a tax liability will arise – and with it a not so simple calculation example.

Let’s take a quick look at the following example:

- Purchase of 1 BTC for 50.000€

- BTC increases to 70.000€

- Exchange of BTC for ETH (no taxable event).

- ETH purchased rises to 80.000€

- Sale of half of the ETH at 40.000€ (taxable event)

How much tax is now due?

40.000€ – 25.000€ (original purchase cost of the BTC, which was transferred to ETH during the exchange), from this sum then 27,5%.

15.000€ * 27,5% = 4.125€

So the tax on the sale is 4.125€

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">With the Blockpit tax software for cryptocurrencies, exactly such calculations are done for you fully automatically. So the days when you had to laboriously keep a record of your crypto transactions in an Excel file are over once and for all. That’s a good thing.</p></div></div></div>

Why do I have to pay crypto taxes in Austria?

Even though no one likes to do it, paying taxes makes perfect sense. With tax money, the state can build hospitals, roads and schools. It can support people without jobs and in other precarious situations and distribute wealth more fairly.

In Austria, you have to take care of your crypto taxes independently, as the tax is not deducted at the source (e.g. broker). This is referred to as the obligation to cooperate.

So you can’t just wait for the government to approach you. Instead, you have to become active yourself and disclose all tax-relevant facts completely and truthfully.

The Blockpit crypto tax calculator can save you a lot of work!

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Starting in 2024, if you are liable to pay tax in Austria, crypto KESt will be automatically deducted for a domestic broker or exchange.</p></div></div></div>

Taxation of Crypto Transactions

When do I have to pay crypto taxes in Austria?

Taxes on crypto arise when you make profits when exchanging or trading and when you earn income (current income) from crypto. Depending on the type of inflow (gains from exchange, gains from trade or income), the progressive income tax rate (0 – 55%), the special tax rate (27,5%) and the special feature: tax exemption after a one-year holding period applied in the previous tax regime.

All this has been simplified with the 2022 tax reform.

With the new tax reform in effect since March 1st, 2022, pretty much all crypto transactions are taxed at the special tax rate of 27,5% across the board (exceptions to this, of course, we’ll list for you).

In principle, the new taxation rules also apply to current income from cryptocurrencies – and regardless of whether old assets or new assets are used.

We will look at both situations, the old and the new rules.

Exchange of cryptocurrencies

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Crypto can be exchanged for crypto (BTC, ETH, etc.) or for FIAT (euros, dollars, etc.).

Previously, one had to pay tax on crypto-to-crypto exchanges and crypto-to-fiat exchanges. The amount of tax depended on the total income (progressive income tax rate). In exchange, crypto could be sold tax-free after one year (hold for 365 days).

This still applies to all crypto assets received through exchange or purchase until February 28th, 2021. This is called legacy holdings.

With the new tax regime, crypto-to-crypto exchanges become tax-free. Tax is paid only for the exchange from crypto to fiat with the special tax rate of 27,5% anymore.

But beware: the acquisition cost is carried forward for a crypto to crypto exchange. See the following example:

- Purchase of 1 BTC for 50.000€

- BTC increases to 70.000€

- Exchange of BTC for ETH (not a taxable event).

- ETH purchased increases to 80.000€

- Sale of half of the ETH at 40.000€ (taxable event)

What is the amount of tax that is due?

40.000€ – 25.000€ (original purchase cost of the BTC, which was transferred to ETH during the exchange), from this sum then 27,5%.

15.000€ * 27,5 % = 4.125€

So the tax on the sale is 4.125€

The exchange from fiat to crypto is considered a purchase under both regulations. In this case, no tax is incurred.

Trading with cryptocurrencies

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Progressive Income Tax</div></div>

Futures and margin trading means trading financial instruments and exchange contracts. The subject of these contracts are not cryptocurrencies themselves, but a legal position (for example, on a delivery of cryptocurrencies or option right).

For example, in a 100.000€ trade, with a 10:1 leverage, you are only using 10.000€ of your own capital. Leverage amplifies the result.

With successful trades one achieves substantially higher profits, than only with own capital.

With unsuccessful trades correspondingly higher losses.

When exchanging cryptos for margin or futures products, realized appreciation, as well as gains from margin or futures trading, are taxed at the progressive income tax rate under both the old and the new regime.

Crypto Income

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Special Tax Rate 27,5%</div></div>

Here we give you a first overview of when you have to pay taxes. Details on the individual DeFi transactions can be found below.

Specifically, you pay taxes:

- When you get paid your salary in cryptocurrencies.

- When you exchange your cryptocurrencies for fiat money (euros, dollars, pounds, etc.)

- For receiving or disposing of DeFi remuneration:

When taxing DeFi consideration, you must keep in mind a basic distinction:

1) If you leave your cryptocurrencies to other market participants (e.g. a network or specialized companies), then the special tax rate (27.5%) is already applicable at the inflow.

It does not matter whether the income is paid out in cryptocurrency or fiat money, or whether it is a centralized or decentralized protocol.

This always applies if public placement is given, which can generally be assumed in the DeFi area.

If there is no public placement, tax is paid at the progressive income tax rate instead and the loss offset is also different.

Mining, lending, staking, liquidity mining and yield farming or liquidity providing may fall into this category.

2) However, income from (delegated) staking, airdrops, bounty or affiliate rewards or hardforks is not taxable at inflow. The acquisition costs are to be recognized at zero. Only upon subsequent sale against fiat currencies, the special tax rate (27.5%) applies.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Because cryptocurrencies no longer fall under speculative income, but under capital gains, the previously valid exemption limit of € 440 is history. As of now, it only applies to NFTs (non-fungible tokens, note). NFTs still do not count as cryptocurrencies and thus remain other economic goods. They continue to be treated as physical gold and can be sold or traded tax-free after the one-year holding period.</p></div></div></div>

Note: Profits from NFT trades and sales exceeding 440€ and realized within the one-year holding period (365 days) must be taxed at the progressive income tax rate (0 – 55%).

When do I not have to pay crypto taxes?

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

If you bought your cryptocurrencies before February 28th, 2021 and held them for at least 1 year (365 days), you won’t have to pay taxes when exchanging them for other cryptocurrencies or fiat money (euros, dollars, etc.).

You remain tax-free in addition:

- When you buy cryptocurrencies with fiat money.

- When you transfer cryptocurrencies between your wallets

- When you HODL and don’t touch your cryptocurrencies

- When you donate or give away cryptocurrencies

With the new tax reform of March 1st, 2022, the following transactions will also become tax-free:

- Inflows from staking, airdrops, bounties or hardforks will not be taxed upon inflow and thus will not result in current income

- Exchange of cryptocurrencies (e.g.: BTC → USDT).

Taxation of DeFi-Assets

Fortunately, the BMF has provided clear guidelines on DeFi taxation with the new regulation.

The following basic distinction applies: When cryptocurrencies are transferred to third parties (as is the case, for example, with Lending), the rewards are taxed once at 27,5% upon inflow and a possible capital gain is also taxed later at 27,5% upon disposal.

If only existing cryptocurrencies are used and they are not transferred to third parties, the inflow of rewards is not taxed. The acquisition costs are to be valued at 0€ and a later sale is taxed at 27,5%.

Here you can find a detailed listing:

Taxation of Mining by individuals in pools.

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Irrespective of the consensus mechanism: 27,5 % on inflow and on sale of the capital gain.

Taxation of Staking

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Not taxable on inflow (zero approach) and 27,5% on sale (with few exceptions)

<div fs-richtext-component="info-box" class="info-box warning"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f473e84badfdd6e059e_Care.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">There are countless forms of staking, which must be considered on a case-by-case basis. See the details in the corresponding chapter.</p></div></div></div>

Taxation of Lending

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

27,5 % on inflow and on sale of the capital gain

Taxation of Borrowing

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

No taxes

Taxation of Bounty and Affiliate programs

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Inflow 0€, sale 27,5%

Taxation of Yield Farming

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

27,5% on inflow and 27,5% on sale (Attention: Both depends on the individual case, please ask your tax advisor).

Taxation of Liquidity Mining

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

27,5% on inflow and 27,5% on sale (Attention: Both depends on the individual case, please ask your tax advisor).

Taxation of Airdrops

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Inflow 0,€ sale 27,5%.

Taxation of Hard and Soft Forks

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Soft forks are disregarded for tax purposes. Hard-Forks: inflow 0€, sale 27,5%.

Taxation of NFT sales

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Progressive Income Tax</div></div> <div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Within 1 year (365 days) at income tax rate (0-55%); after 1 year: tax-free

Taxation of NFT trading

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Progressive Income Tax</div></div> <div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Within 1 year (365 days) at income tax rate (0-55%); after one year: tax-free

Taxation of Play to Earn

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

27,5 % on inflow and on sale of the capital gain

Tax on Learn to Earn

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

27,5 % on inflow and on sale of the capital gain

How is Mining of cryptocurrencies taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Mining has to be differentiated whether it is done for private or commercial purposes. If it is used for private purposes, profits are now taxed at the rate of 27,5% upon inflow. Any increase in value will also be taxed at 27,5% upon disposal.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Real certainty as to whether someone is operating privately or already commercially can only be obtained by looking at the individual case. In principle, however, the question always arises as to whether a commercial activity is being carried out in the overall picture. A high number of transactions or high-priced transactions per se do not necessarily lead to a commercial location.</p></div></div></div>

How is Staking taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Staking rewards do not constitute income and the acquisition costs are to be assessed at zero. So there is nothing to pay tax on when they are received.

However, if you later sell the Staking Rewards, you have to apply the tax rate of 27,5%.

Example: You have earned 500€ in ETH through staking in May 2022. The value of this cryptocurrency doubles and you sell. So you have to tax this 1.000€ at 27,5%.

Important: Staking rewards are only not taxed on inflow if they come from classic staking, where your cryptos are used for transaction processing (“block creation or validation”). The rule of thumb for this is that on-chain transactions are performed directly on the blockchain.

If, on the other hand, “staking” offers are used by platforms or exchanges that are offline, then it is lending according to the new legal situation. Your rewards are then already taxable upon inflow.

How is Lending taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Regarding Lending, you have to consider the time of inflow. In this case, tax is payable on the inflow and on the subsequent increase in value when the asset is sold. The amount of tax in both cases is 27,5%.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Since the tax liability arises at the inflow, with the price of the coin at the time of inflow, plan during the year again and again for your tax, in which you repeatedly sell coins. That way, you’ll be prepared should the price of your Coin drop at the end of the year when your tax is due.</p></div></div></div>

How are Bounty or Affiliate programs taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

If you participate in a bounty or affiliate program in the crypto space, then you will mostly get free cryptocurrencies in return.

Here, the new government bill makes it very easy for you. You only have to pay attention to the fixed tax rate of 27,5%, at the time of sale. The acquisition costs have to be set at 0€, and the taxation of the gains takes place at the time of sale.

How are Yield Farming and Liquidity Mining taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

With regard to yield farming and liquidity mining, two processes must be distinguished:

1. Exchanging assets into a yield farming protocol or into a liquidity pool:

In our view, both operations are generally swaps, i.e., non-taxable crypto-to-crypto transactions.

2. Rewards flowing to you:

Whether the rewards are taxed when they flow to you depends on whether the cryptocurrencies used are left to other market participants. According to the crypto tax reform materials, this is the case here, making the Rewards taxable at 27,5% upon inflow. Any appreciation is also taxed at 27,5% upon disposition.

Note: This view on both processes depends on the individual case, please ask your tax advisor.

How are Airdrops taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Airdrops, also called gratuitous transfers, do not constitute income. They are mainly issued to publicize newly emerging projects in the field of blockchain technology and transferred to a wallet for free without any consideration.

Therefore, the acquisition cost is considered to be 0€.

If you sell airdrop gains, you have to apply the 27,5% tax rate at the time of sale.

How are Hard and Soft Forks taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Regarding soft forks, it’s quite simple. Since you don’t get any new cryptocurrencies here, there is also nothing you have to pay tax on.

With hard forks, the BMF differentiates, as you actually receive new cryptocurrencies here.

However, since these have a value of 0€ when issued, no taxes are charged when received. When you sell them, the tax rate of 27,5% applies to any gains.

How are NFTs (Non-Fungible Tokens) taxed in Austria?

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Progressive Income Tax</div></div> <div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

NFTs are “non-fungible tokens.” They are not addressed in the new draft law and therefore do not fall under the definition of a cryptocurrency.

This means that the new tax rules will not apply to NFTs and the old rules will still apply.

So, if you hold NFTs for more than one year (365 days), your gains will be tax-free.

If you sell NFTs within a year, you pay the progressive income tax rate from 0 to 55% on gains.

The same applies to NFT trades: if you trade only after one year, gains are tax-free.

If you don’t want to wait that long, you pay the progressive income tax rate of 0 to 55% on gains.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">For NFTs, there is still an exemption limit of €440. Gains below this limit remain tax-free even if you sell within one year. Attention: As soon as your profit is one Euro above the exemption limit, you have to pay tax on your entire profit at the progressive income tax rate.</p></div></div></div>

How are exchange fees taxed in Austria?

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Deductable</div></div>

In Austria, you can record transaction fees, such as Gas Fees, as deductible expenses and offset them against your profits.

However, it’s important to note that Blockpit already includes these fees as incidental acquisition costs. Therefore, they are already accounted for in the actual profit and don’t need to be separately listed in the tax declaration.

For transactions that involve both an outgoing asset and a fee, the fee is accounted for after the outgoing asset based on the FIFO (First In, First Out) principle.

{{cta-banner-tax-generic="/elements/reusable-components"}}

Optimizing Your Crypto Taxes

Is it possible to avoid crypto taxes in Austria?

Crypto taxes may not be evaded. Even if no one likes to do it, paying taxes makes perfect sense. With tax money, the state can build hospitals, roads and schools, it can support the poor and unemployed and distribute wealth more fairly.

Tax evasion is illegal and can result in a fine or, in serious cases, imprisonment. In addition, the evaded taxes plus interest and late payment penalties must be paid.

However, what is already possible is to optimize your crypto taxes. You can read how this works in the next section.

How to optimize taxes on crypto profits (and pay less taxes)

Even with the new government bill, there are still ways you can effectively optimize your taxes, leaving you with more money.

The easiest way is to hold legacy cryptocurrencies for longer than 1 year (365 days). In this case, you won’t have to pay taxes.

Another tip for cryptocurrencies from new holdings is not to withdraw your cryptocurrencies into a fiat currency such as EUR, but instead convert them into a stablecoin such as USDT.

This way, you bypass the high volatility in the crypto market while enjoying the benefits that come with a stablecoin. It’s a worthwhile option since with the new government bill, crypto-to-crypto exchanges are tax-free.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Nevertheless, stablecoins must also be viewed with caution, as the case of Terra’s stablecoin UST has shown.</p></div></div></div>

Last but not least, you can also offset accruing crypto gains or losses with gains and losses from other capital market transactions, such as stocks.

How to offset crypto losses

Crypto assets were defined as income from capital assets for the first time with the new tax reform. As a result, crypto losses can be accounted for as capital losses.

One way you can optimize your taxes is by realizing and offsetting crypto gains and losses against gains from other capital market transactions (e.g., stocks, bonds, distributions, and derivatives) in the same tax year (Jan. 1-Dec. 31).

This makes sense, for example, if gains and losses were realized by selling crypto assets in fiat currencies. The exchange between two crypto assets is tax-free with the new tax reform of March 1st, 2022, and accordingly cannot trigger taxable gains or losses.

Of course, these bills will only become relevant for you with the tax return for 2022, which you can file from Jan. 1st, 2023 at the earliest.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">With Blockpit’s tax optimization feature, you can easily identify tax-free profits. By the way: Blockpit is available in the Basic license starting at 99€ per tax year.</p></div></div></div>

Does the Federal Ministry of Finance know that I hold or trade cryptocurrencies?

Yes. The Federal Ministry of Finance already works closely with existing crypto exchanges, which in turn release KYC (Know Your Customer, note) data to ensure compliance requirements in Austria.

Also, with the EU Commission’s upcoming DAC-8 directive, the Federal Ministry will be able to check if you own cryptocurrencies.

Do I also have to pay taxes on crypto gains that happened years ago?

Yes. You should keep a record of your cryptocurrency transactions for the last 10 years. After all, there is definitely a chance that you will be audited. And especially in the volatile crypto space, amounts can add up quickly.

The easiest way to do this is to keep continuous documentation with Blockpit’s crypto tax software, which clearly and automatically documents the transaction date, the value in euros on the transaction date, the intended use and the recipient.

If you are not sure whether you have correctly declared the transactions of your cryptocurrencies and assets, it is best to proactively contact the BMF, as there is a duty to correct incorrect declarations.

{{cta-banner-tax-generic="/elements/reusable-components"}}

Automating & Filing Your Tax Report

How do I do my tax return for cryptocurrencies?

You can submit your tax return both digitally via FinanzOnline and in paper form by mail. There is an overview of relevant tax forms at the Ministry of Finance.

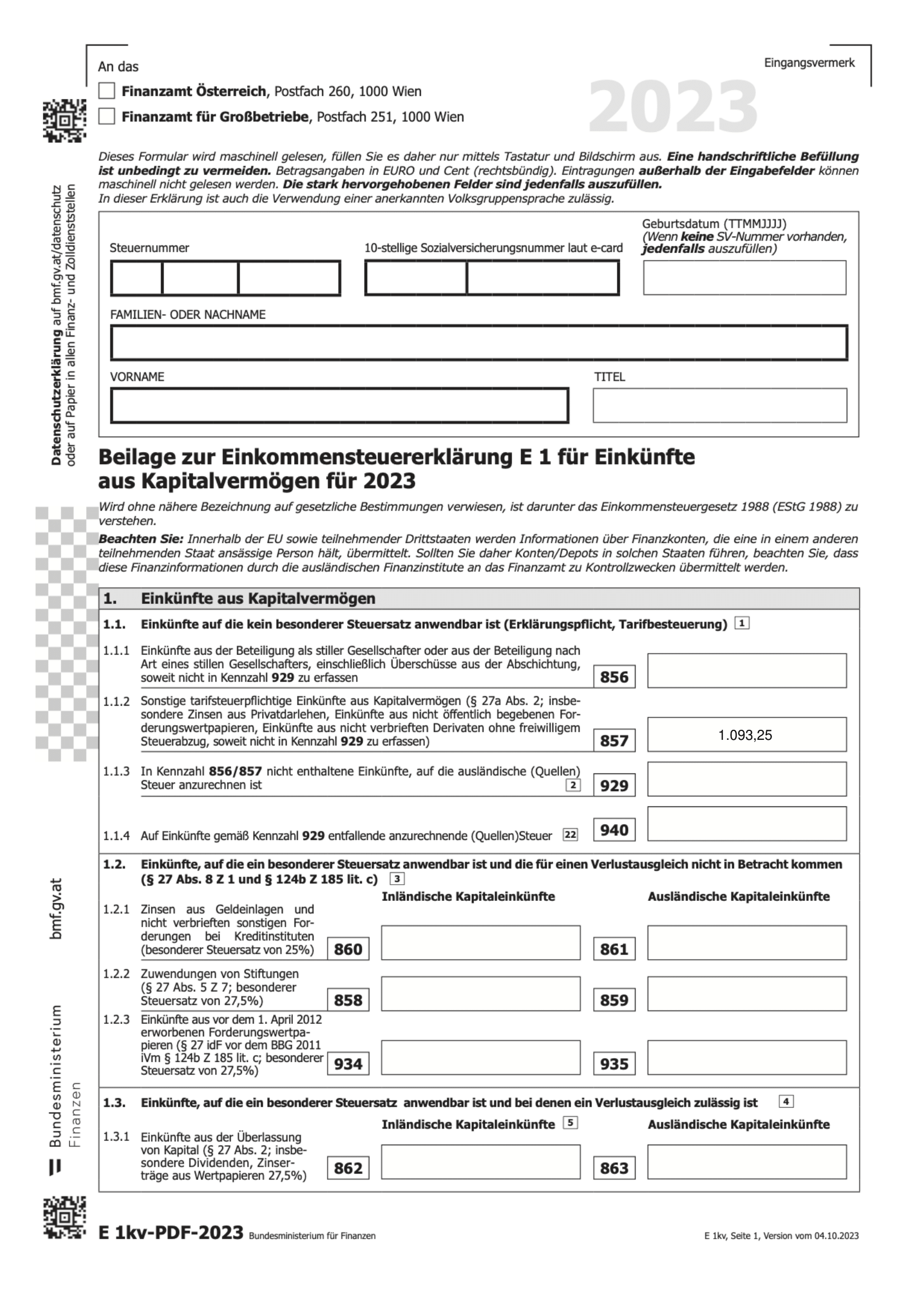

Where do I enter cryptocurrencies in my tax return?

The most important form for you is the E1 form. The latest submission date is June 30, 2024. You can find more information on any deadline extensions in the previous question.

Do I have to declare my entire crypto holdings or only my profits in my tax return?

No, you do not report your entire crypto holdings on your tax return. Instead, you declare your profits or losses and declare income from cryptocurrencies.

By when do I have to file my tax return for my crypto profits?

Generally, a tax return is always filed for a year that has already passed. So if you want to do your tax return for 2023, you can do it in 2024 at the earliest. For the annual tax return in Austria, the form in which you file it is decisive.

- Earliest possible submission: mid-February of the following year

- In paper form: by April 30 of the following year

- Online: by June 30 of the following year

- Via tax advisor: deadline extension can be requested

What happens if I do not file my crypto tax return?

In Austria, there are new legal regulations regarding the tax treatment of cryptocurrencies since March 1, 2022. They also apply to cryptocurrencies acquired after February 28, 2021.

Those who do not comply with these regulations must justify themselves in the event of a possible inspection in Austria and sometimes face severe penalties. Depending on the severity, this can involve a tax refund, high fines or even imprisonment.

In the event of a suspicious case, the tax authorities can investigate retroactively for up to 10 years. For reasons of transparency and traceability alone, it is therefore advisable to document all crypto transactions of the last few years.

This can be done better than with an Excel document with the Blockpit crypto tax calculator, which clearly prepares your portfolio and correctly calculates crypto taxes for you.

Income determination and average cost basis (ACB)?

The tax base in the event of disposal is the difference between the sale proceeds and the acquisition costs. It's important to note that the acquisition costs must include incidental acquisition costs. In the case of a cryptocurrency exchange, the fair market value of the cryptocurrency given up should be considered as the sale proceeds.

When cryptocurrencies are acquired in chronological succession and stored on the same cryptocurrency address, they must be valued according to the cryptocurrency regulation using the weighted average price (and - according to general tax principles - always in euros).

Income from realized capital gains, accruing from January 1, 2023, should be calculated using the ACB.

The following do not enter into the weighted average price:

- Old stock; if both old and new assets are present, the taxpayer can make an allocation in the event of disposal.

- Cryptocurrencies whose acquisition costs were set at a flat rate during capital gains tax deduction.

- For disposals on December 31, 2022, and before, the FIFO method or even a free allocation of the tranches - if clearly documented - is to be applied.

Crypto tax software: How Blockpit automates your crypto tax return.

If you’ve ever filed a tax return, you know how many hours can go into research, documentation, and preparation.

With Blockpit’s legally compliant tax reports, you not only save yourself a lot of time, you also get a comprehensive overview of all your crypto transactions and ultimately exactly what you really need: a legally compliant PDF that you can easily submit to the tax office.

To give you a better idea of the whole thing, we show you the most important screenshots from a sample Blockpit tax report here. You want to have a look at every detail? Here’s the full PDF of our crypto tax sample report.

Crypto Tax Report Overview

This is what it looks like, the Blockpit tax report as a handy PDF that you can submit directly to the Austrian tax office. Right at the beginning, it gives you an overview of your income from speculative transactions and services, as well as capital gains related to cryptocurrencies.

Income tax return form

This is followed directly by the appropriate BMF form for submitting the income tax return. Practical: Blockpit not only calculates the amounts to be declared for you, but also enters them in the correct field right away.

Individual transaction list

With the exact listing of all your transactions, you always have the complete history of your crypto year in view. Great for a manual check and of course also as a documentation aid in case of any inquiries.

{{cta-banner-tax-generic="/elements/reusable-components"}}

FAQ

Sources & References

Update Log

02/2024: Update for 2024 / New tax forms / Information about the average cost basis (ACB)